If you are falling behind on your mortgage payments and facing foreclosure, a loan modification is the best way to stop the foreclosure and stay in your home. In order to apply for a loan modification, it is critical that you act fast and have the necessary information. Our law firm has the resources and experience to offer the best representation for loan modifications in New Jersey.

Loan Modification

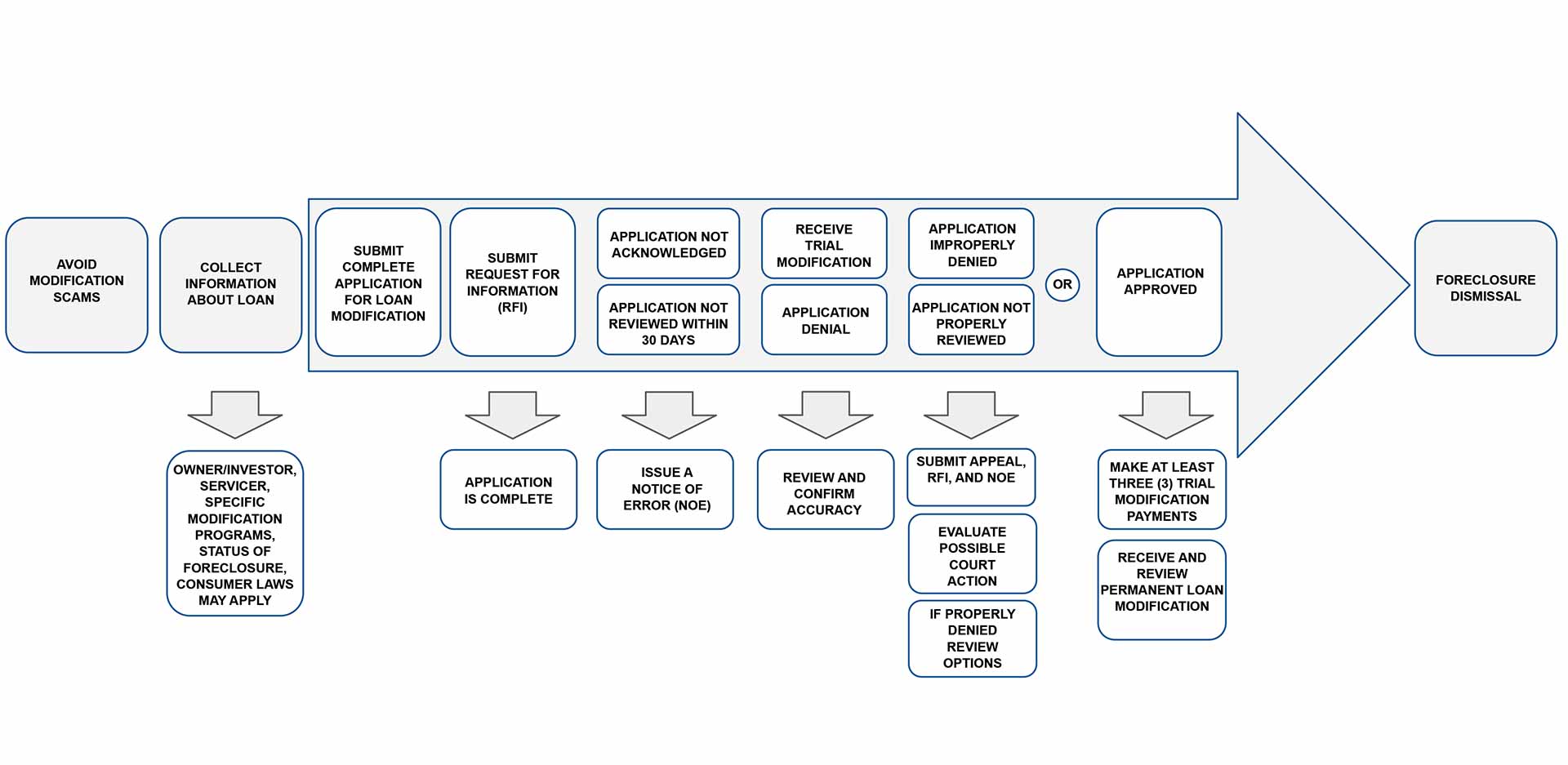

Understanding the Loan Modification Timeline in New Jersey

Here is a printable document explaining the process and steps you need to take for applying for a loan modification in NJ. We will help you answer all of these questions and assist you every step of the way.

Table of Contents

Show Table of Contents

- How Do I Spot A Loan Modification Scam?

- Who is the Current Servicer?

- Who is the Owner Or Investor For The Loan?

- What Type of Modification Program Will Be Used?

- How Do I Determine What Consumer Protection Laws Apply?

- Determine The Status Of Any Foreclosure

- Prepare And Submit A Complete Modification Application

- After Application is Submitted, Request For Information (RFI) And Notice Of Error (NOE), If Applicable

- Notice Of Error (NOE) If The Application Is Not Reviewed Within 30 Days

- Receive And Review Trial Modification (Trial Payment Plan) Or Denial And Review To Confirm It Is Accurate

- What Do I Do If My Modification Was Properly Denied?

- If Application Was Not Properly Reviewed, Evaluate Possible Court Action

- If Modification Was Approved, Make At Least Three (3) Trial Modification Payments

- After Completion Of Trial Payment Plan, Receive And Review Permanent Modification

- Once Permanent Modification Is Fully Executed, Confirm Foreclosure Is Dismissed

- Do I Qualify For A Loan Modification? What Would The Payments Be?

- What Loan Servicers Have You Obtained Loan Modifications For Your Clients From?

- Do You Have A Loan Modification Expert On Staff?

- What Are Your Rights to a Loan Modification From Your Mortgage Lender or Loan Servicer?

- What Are Some of the Most Common Modification Violations Made By Servicers?

- What Are The Different Types of Loan Modifications?

- Where Do You Provide Loan Modification Services?

- How Long Does the Loan Modification Process Take?

- Can I Apply for a Loan Modification if I am Currently Unemployed?

- Will a Loan Modification Stop Foreclosure?

- Can I Appeal a Loan Modification Denial?

- Can I Get a Loan Modification If My Mortgage is Underwater?

- What Documents Do I Need to Apply for a Loan Modification?

- What is a Loan Modification?

- Why Did My Lender Reject My Loan Modification?

- How Can I Avoid Fake Loan Modification Companies?

- Can I Be Denied a Loan Modification Due to a Title Issue in NJ?

- Is There a Fee for Applying for a Loan Modification?

- What Happens if I Miss a Payment During the Trial Modification Period

- Can I Refinance My Home After a Loan Modification?

- Are There Special Loan Modification Programs for Veterans?

- What's the Difference Between Loan Modification and Forbearance?

- Can I Apply for a Loan Modification More Than Once?

- What Are the Possible Disadvantages of a Loan Modification?

- How Are Interest Rates Determined in a Loan Modification?

- What to Do if I'm Denied a Loan Modification Due to Incomplete Documentation?

- Is Loan Modification Possible on an Investment Property?

How Do I Spot A Loan Modification Scam?

Spotting a loan modification scam may seem difficult, but there are several signs to look out for, including the following:

- You get a letter that looks like a modification pre-approval.

- You get notices that look like they are from the government.

- You get notices that look like they came from a mortgage company.

- They tell you that you are about to lose your home.

- You cannot speak to the attorney that is handling your file.

- They promise a 2% interest rate.

- They promise principal reduction.

- They tell you that you don’t need tax returns.

- They tell you they can lower your payment without taking any information from you.

- They are not a NJ-licensed attorney or a NJ-licensed debt adjuster.

- They are not located in NJ.

- They are not prepared to help you go to Court or stop a sheriff sale.

Who is the Current Servicer?

The loan modification application must be submitted to the current loan servicer. This is normally the company that is sending the monthly mortgage statements. The monthly statement will have necessary information like the loan number, interest rate, payment amounts, amounts due and the address that can be used to communicate with the Servicer. It is important to open all mail because the Servicing can be transferred and if you send the application to the wrong servicer, there is no chance to stop a foreclosure or get a modification.

Who is the Owner Or Investor For The Loan?

Knowing the Owner/Investor can be the most important piece of information available and will tell you what types of modifications may be available. If your loan is “Federally Backed,” meaning it is with FHA (Federal Housing Authority), VA, Fannie Mae or Freddie Mac, your modification programs are publicly available and the Servicer must abide by them. You can find out if your loan is “Federally Backed” through these searches:

- Find Out if Your Loan is Owned by Fannie Mae Here

- Find Out if Your Loan is Owned by Freddie Mac Here

- To Find Out if you have a VA-guaranteed loan, there is specific language in the note and mortgage identifying it as a VA loan, and there are fees paid to the VA.

- Find Out If Your Loan Is Backed By The Federal Housing Authority (FHA) By Calling:

- 1-800-CALL-FHA (800-225-5342) or HUD’s National Servicing Center at 877-622-8525

- You can also try calling your lender to ask if your mortgage loan is “enterprise backed.”

If your loan is not “Federally Backed,” the modification programs will be determined based upon an agreement between the Owner/Investor and the Servicer. Some Owners/Investors have specific guidelines and instruct the Servicer as to what types of Modifications they can offer. However, other Owners/Investors allow the Servicers to determine what Modification Programs to offer. You can try to find out the Owner/Investor by calling the Servicer, but the best way is to send a written Request for Information (RFI) to the Servicer and ask the name of the Owner/Investor. If the RFI is sent to the designated address, by certified mail, the Servicer MUST respond in writing. This address is required to be on the monthly mortgage statement. If there is any doubt as to the Owner/Investor, we always send the RFI.

What Type of Modification Program Will Be Used?

FHA, VA, Fannie Mae and Freddie Mac all have publicly available modification guidelines. They are difficult to read and understand, but they are available and if the Servicer does not follow them, there can be grounds for a Federal lawsuit or a defense to a foreclosure. The Federally Backed loans all have modification programs for Borrowers at the end of a Forbearance or for Borrowers affected by the Coronavirus Emergency.

Learn more about modification after forbearance for Federally Backed loans

If the loan is not “Federally Backed,” it could be based upon:

- A borrower’s income

- The value of the property

- The amount owed

- Ratios for income and expenses

- Some other combination of these factors

In our office, we rely upon an expert at this stage of the process, Roberto (Bobby) Rivera. My clients are advised that I can handle the legal aspects of the process, but I am not a mathematician. Bobby makes his living tracking all the different modification programs from the lenders and Servicers and he performs all of our calculations to apply for modifications. Bobby is uniquely qualified. He works across the country and has lectured and taught lawyers how to properly apply for modifications. He can confirm that an application will be in proper form for a specific Federally Backed loan. Additionally, over the years we have done many, many modifications for loans that are not Federally Backed and we track and save the information from each modification, so we have a good idea of what to expect when we do a new application for a Servicer with a specific Owner/Investor.

Modifications are mathematical formulas. The Servicer does not look at the hardship letter and a Borrower’s file to decide if they deserve help. The question is whether the numbers work. Once we can identify the Owner/Investor and the Modification program they will likely use, we can determine how best to use the Borrower’s financials to complete the mathematical formula and get the best modification possible.

Knowing the program that will be used allows us to determine whether to use non-borrower contributions; what expenses will be reviewed; or the proper target monthly income for self-employed individuals who will be submitting a Profit and Loss Statement instead of pay stubs to show income. This can mean the difference between getting the best possible modification terms, or getting approved at all. Some people think they have to show as much income as possible, so they add income from other members of the household, or they will even rent rooms to have more income. However, with some modification programs, you don’t need to show so much because the program is designed to be based upon the Borrower’s income, and principal can be forgiven or deferred to make an affordable payment, without income from others.

Bobby has been preparing our modification applications for about five (5) years, and if I needed a modification for my home, I would not go to anyone else.

FHA, VA, Fannie Mae and Freddie Mac will have several different modification programs available, and if you don’t know the requirements of the programs, you are not giving yourself the best chance for the best modification available. For example, FHA offers a “Partial Claim” Modification, in which they can take up to 30% of the principal and put it in a new loan with no interest. This allows the interest payment to be greatly reduced. There are no monthly payments for this second loan, but it does need to be paid if the property is refinanced or sold. However, to be reviewed for this program, your application must show specific ratios and percentages. This is where you don’t need a lawyer, you need someone who knows how to best prepare the modification application. Bobby can do the math to tell us whether we can be reviewed for the “Partial Claim.”

Once we know the Owner/Investor and the Modification Program that will be used, and we have our clients’ financials, we have a good idea of whether the application can be successful, and we can usually estimate the terms of a modification.

How Do I Determine What Consumer Protection Laws Apply?

We are a Consumer Defense Law Firm with a focus on Foreclosures and Modifications. Additionally, we pursue claims under the Fair Debt Collection Practices Act (FDCPA) when the lenders, and/or their attorneys take improper steps to collect the debt. Before a modification application is submitted, we want to know what Consumer Protection Laws apply. For a Homeowner who is living in a 1-4 unit property and who has not been reviewed for a Modification by the current Servicer since January 1, 2014, almost all the applicable Consumer Protection laws should apply. These are:

- Truth in Lending Act (TILA)

- Real Estate Settlement Protection Act (RESPA)

- New Jersey Consumer Fraud Act (NJCFA)

- Fair Debt Collection Practices Act (FDCPA)

Some reasons that these laws may not apply to a specific Modification Application can include:

- The Servicer has reviewed a prior Modification Application since 2014

- The property is more than 4 units

- The Borrower no longer lives in the property and it is used as an investment property

- The property is vacant or abandoned

- The property is used for commercial purposes

When there is an issue or concern about RESPA or TILA or the NJCFA, or the case is complex, we have a valuable resource for our clients. Dann Law is a multi-state Law Firm that has a focus on RESPA and TILA. Many of our clients have been represented by Dann Law in Federal Actions against the lender or their attorneys, and I have Co-Counselled cases with them.

Javier Merino, Esq. is the Partner of Dann Law responsible for NJ. You can view their information and some of our successes here:

- D’Alessandro v. Ocwen Loan Servicing – Prevailed on a Motion to Dismiss in the District of New Jersey under the Consumer Fraud Act.

- Duffy v. Wells Fargo Bank, N.A. – Prevailed on a Motion to Dismiss in the District of New Jersey under RESPA.

- Alfaro v. Wells Fargo, N.A. – Prevailed on a Motion to Dismiss in the District of New Jersey under RESPA.

- Ghulyani v. Carrington Mortgage Services, LLC, et al. – Prevailed on a Motion to Dismiss in the District of New Jersey under the Consumer Fraud Act and for claims of breach of contract.

- Mannarino v. Ocwen Loan Servicing, LLC. – Prevailed on a Motion to Dismiss in the District of New Jersey under the FDCPA, RESPA, and the breach of duty of good faith and fair dealing.

- Grembowiec v. Select Portfolio Servicing, Inc. – Prevailed on a Motion to Dismiss in the District of New Jersey for claims under RESPA.

- Ebner v. Statebridge Co., LLC. – Prevailed on a Motion to Dismiss in the District of New Jersey for claims under the FDCPA.

- Davidson v. Caliber Home Loans, Inc. – Prevailed on a Motion to Dismiss in the District of New Jersey for claims under RESPA and the FDCPA.

Determine The Status Of Any Foreclosure

The status of a foreclosure is critical in the modification process. In most instances, the Modification Application MUST be submitted at least 37 days prior to the Sheriff Sale. However, it should be submitted at least 45 days prior to the Sheriff Sale to make sure the most protections are in place. As long as the “Complete“ application is being reviewed, the Lender cannot conduct the Sheriff Sale.

Based upon the status of the Foreclosure, there can also be strategic decisions about when to submit the application. In most instances, if a “Complete“ application is being reviewed, a Lender cannot file a Foreclosure Complaint. In most instances, if a “Complete” application is being reviewed, a lender cannot file an Application for Final Judgment.

Accordingly, we need to know where the Foreclosure stands, so we can best advise our clients about the timing of the application and the protections that can be expected.

Some reasons that the application may not stop the foreclosure are:

- If the Servicer has reviewed a prior Modification Application since 2014

- If the property is more than 4 units

- If the Borrower no longer lives in the property and it is used as an investment property

- If the property is vacant or abandoned

- If the property is for a commercial use

Prepare And Submit A Complete Modification Application

Once we know the Servicer, the Owner/Investor, the Modification program we believe will be used, the laws that apply and the status of any Foreclosure, we are ready to prepare and submit a complete application. It is always my advice not to submit an application in pieces. It should be complete in one package with proof of delivery, so that if there are any issues with the review, there can be no claims that they never received some of the documents. If available, we will send the Modification Application by email or fax, but we will always send hard copies to the designated address and to the attorneys if there is a foreclosure. To have the best protections, all submissions need to be made to the address designated by the lender and we always make sure we have proof of delivery.

If there is a Sheriff Sale scheduled and we adjourned the sale to have time to submit the application, we always include the letter from the Sheriff to confirm the sale has been adjourned and there is enough time for a review. The Servicer does not get automatic notice when a Borrower requests an adjournment. They have the date in their system that was provided by their attorneys. They need to be made aware that the sale has been postponed and there is time for the review.

After Application is Submitted, Request For Information (RFI) And Notice Of Error (NOE), If Applicable

If RESPA or TILA applies, the lender must acknowledge receipt of the application and advise if anything else is needed, within five (5) business days. If we do not hear from the Servicer, we will send a RFI (Request for Information) pursuant to 12 CFR § 1024.36, to ask them to confirm:

- That they received the application

- That they did not ask for any additional documents or information

- That the application is complete

- That the application will be reviewed within 30 days

At the same time, we will send a NOE (Notice of Error), pursuant to 12 C.F.R. § 1024.35 to put them on notice that they are in error for failing to acknowledge receipt of the application.

The letters MUST be sent to the address designated by the Servicer and the letters MUST be sent by certified mail. These are necessary steps to protect the homeowner and prepare to litigate if the Borrower is improperly reviewed for the modification. Under the rules, a lawsuit can be brought for failing to correct the situation after a NOE is received. A lawsuit cannot be brought under TILA and RESPA for failing to acknowledge receipt of the application, unless an NOE has been properly issued. If we have to litigate, we want as many claims as possible, so this is the first step to try to set up a case for the Homeowners if they are improperly denied. Additionally, if the application is properly denied, there can still be grounds for a Federal Lawsuit and, in many cases, a Servicer will grant a modification to settle litigation. It is improper for a Debt Collector to contact a Consumer that is represented by an attorney, so we advise our clients to tell us about all communications they receive during the modification process.

Notice Of Error (NOE) If The Application Is Not Reviewed Within 30 Days

The Servicer is required to review a complete application within 30 days of receipt. We always try to get written confirmation from the Servicer that the application is complete. If we have written confirmation that the application is complete and it is not reviewed within 30 days, that is a violation. However, many times, we will not get the written confirmation, so we must create it. If we do not hear from the Servicer within 30 days after we submit the application, we will send a Notice of Error if they did not request any additional documents or information, and that they did not review the application within 30 days. It is important to understand that a lawsuit is for violating the rules and, if successful, the Servicer would be required to pay penalties and attorney fees. A successful lawsuit often ends with a settlement that includes a modification, but a violation does not automatically entitle the homeowner to a modification.

Receive And Review Trial Modification (Trial Payment Plan) Or Denial And Review To Confirm It Is Accurate

There can be months of submitting documents and sending RFIs and NOEs, but eventually the application will be reviewed, or the Servicer will likely get sued.

In most cases, after the review, the Servicer will either offer a Trial Modification, often called a Trial Payment Plan (TPP), or they will deny the application.

If a Trial Modification is offered, Bobby will review it to be sure it has been properly calculated. If we believe that a better modification should have been offered, we will send Requests For Information to find out about the guidelines for the modification program and the figures that were used. We will also send a Notice of Error to advise the Servicer that there has been an error with modification and that the proper modification must be provided.

You should be aware that you may not get details about the permanent modification until you have made the trial payments. The lender is supposed to wait until you make the 3 payments and then apply those funds to the loan and create the Permanent Modification. Many people want to know the interest rate, payment amount and other details, but in many cases, the Permanent Modification has not been created yet, so the Customer Service Representatives don’t have that information to provide. We normally have a good idea of the terms of the Permanent Modification, but we don’t know for sure until we see it.

If the application is denied, Bobby will review it to see if the correct figures were used and the calculations were done properly. If we believe that the denial was improper and a modification should have been offered, there is a right to an Appeal of the denial. We will also send Requests For Information to find out about the guidelines for the modification program and the figures that were used. We will also send a Notice of Error to advise the Servicer that there has been an error with the review and that a modification must be provided.

Based upon many factors, including but not limited to the fact that modification programs and interest rates can change at time, or the loan could be sold at any time, there is never a guarantee at the time we submit the application.

What Do I Do If My Modification Was Properly Denied?

If the modification is properly denied, it is not necessarily the end. The loan can be sold at any time or the Servicer can change at any time. If the loan is sold, many times it is purchased at a discount and the new Owner/Investor may be able offer a modification. Additionally, if the servicing changes, by law, there is a right to submit a new modification application. The new Servicer may have a different modification program, with different requirements, and a modification may be possible. Depending upon the status of a foreclosure, it may be possible to defend the foreclosure to create time.

Our office does not file Bankruptcies, but it makes sense to speak to an experienced Bankruptcy Attorney to see if that is an option. It is possible that Bankruptcy will provide an option to catch up on the payments and avoid losing the property.

If Application Was Not Properly Reviewed, Evaluate Possible Court Action

Our office has a focus on defending the State Court Foreclosure and bringing claims under the Fair Debt Collection Practices Act (FDCPA). If an application was not properly reviewed, or improperly denied and the lender moves forward with any part of the Foreclosure, including the Sheriff Sale, I am prepared to go to Court to defend my clients. I have filed over 100 motions to Stay or Set Aside Sheriff Sales, and I have successfully Stayed over 35 Sheriff Sales and Set Aside over 25 Sheriff Sales. Additionally, I have obtained more than 10 modifications for my clients as part of Setting Aside their Sheriff Sales.

I have also filed, and successfully settled, several FDCPA Complaints against Lenders, Servicers and their attorneys.

If the proper steps are taken during the application process through Requests for Information (RFI) and Notices of Error (NOE), the Borrower can be in a position to go to Court if the application is not properly reviewed or the modification is improperly denied. In the case where a lender is trying to file a Complaint, Apply for a Final Judgment or Conduct a Sheriff Sale while they were in possession of the complete modification application, and proper notices have been given to the Servicer, it is possible to file a Motion with the Court to Dismiss the Complaint, Deny Final Judgment, Stop a Sheriff Sale or even Set Aside a Sheriff Sale. This also applies if the Borrower was making payments on a Modification or Trial Plan. The lender cannot file a Complaint, apply for a Final Judgment or conduct a Sheriff Sale while any modification is in place.

Aside from stopping the foreclosure, it may also be possible to file a Federal Action against the Servicer under Truth in Lending Act (TILA), Real Estate Settlement protection Act (RESPA), New Jersey Consumer Fraud Act (NJCFA), and the Fair Debt Collection Practices Act (FDCPA).

It may also be possible to file a Federal Complaint under the Fair Debt Collection Practices Act (FDCPA), against the attorneys that took an improper action to collect the debt through the foreclosure.

These cases are best handled by attorneys that are experienced with these laws and the resulting cases. My office handles cases under the Fair Debt Collection Practices Act (FDCPA). However, there are more complexities in suing under the Truth in Lending Act (TILA), Real Estate Settlement Protection Act (RESPA), and the New Jersey Consumer Fraud Act (NJCFA). If we believe that we have created claims under these laws, we encourage our clients to speak with Javier Merino, Esq., of Dann Law. Mr. Merino’s firm handles Mortgage Servicing Litigation in multiple states, and they have the resources to litigate these complex claims with lenders, servicers and their attorneys.

If Modification Was Approved, Make At Least Three (3) Trial Modification Payments

If a Trial Modification (Trial Payment Plan) is approved, at least three (3) payments will be required. It is important to make sure the payments are made on time and the payments should be exactly the amount requested. DO NOT PAY EXTRA. In many instances, they want the exact amount and paying extra could be considered a breach of the agreement. Additionally, DO NOT STOP MAKING PAYMENTS. Even if you have made the three (3) required payments and you are waiting for the Permanent Modification, do not stop making payments. It may take 1-2 more months for the final paperwork to be prepared.

After Completion Of Trial Payment Plan, Receive And Review Permanent Modification

Based upon knowing the Owner/Investor of the loan, we know what Modification Program(s) should be used. However, sometimes errors are made, and we need to issue a Notice of Error (NOE) because the Permanent Modification is not correct. That is a benefit of knowing the programs and being able to do the mathematical calculations under the modification guidelines. If the proper modification terms are not offered in the Permanent Modification or the modification is canceled and a Permanent Modification is not offered, there may be grounds for a Federal lawsuit under Truth in Lending Act (TILA), Real Estate Settlement Protection Act (RESPA), New Jersey Consumer Fraud Act (NJCFA), and the Fair Debt Collection Practices Act (FDCPA).

Once Permanent Modification Is Fully Executed, Confirm Foreclosure Is Dismissed

Once we have confirmed that the Permanent Modification is correct, it must be signed and returned to the Servicer. Most times, it will need to be Notarized because it is going to be filed with the County Clerk. Once we receive a signed copy back from the Servicer, we will confirm that any Foreclosure is dismissed and that the Lis pendens is discharged from the County records.

Do I Qualify For A Loan Modification? What Would The Payments Be?

Generally, you can qualify for a loan modification if you’ve had an income loss or reduction that caused you to miss your mortgage payments. Or you have to be in imminent danger of falling behind on payments. But you must have sufficient income to make modified payments.

At the law firm of Ira J. Metrick, Esq, we can tell our clients if they will qualify for a loan modification and what the new payments would be. We don’t apply for a modification unless we have advised the client of what payment terms they can expect.

We offer aggressive loan modification representation, and can bring federal lawsuits against mortgage servicers and their attorneys if they don’t properly review modification applications.

What Loan Servicers Have You Obtained Loan Modifications For Your Clients From?

We have obtained loan modifications for our clients from several differential loan servicers, including, but not limited to, the following:

- 21st Mortgage Corporation

- ABFC Trust

- Amboy

- BSI Financial Services

- Bank of America

- Bayview

- Caliber

- Carrington

- Christiana Trust

- Citibank / Citimortgage

- Deutsche Bank

- Ditech

- Dovenmuehle

- Everhome

- Fay Servicing

- Freedom

- HSBC

- Indymac

- JP Morgan Chase

- Kondaur

- Loancare

- M&T Bank

- Mellon Bank

- Midfirst

- Mr. Cooper (Formerly Nationstar)

- Ocwen Financial Corporation

- PHH

- PNC

- Provident

- Roundpoint

- Rushmore

- Select Portfolio Servicing (SPS)

- Selene Finance

- Seterus

- Shellpoint

- Specialized Loan Servicing (SLS)

- Statebridge

- Synergy Financial

- TD Bank

- TST Financial

- U.S. Bank

- Wells Fargo

Do You Have A Loan Modification Expert On Staff?

Yes, our loan modification expert is Roberto Rivera. Mr. Rivera is a nationally recognized consultant with over 20 years of experience in loan modification and home retention, having successfully modified loans for over 1,500 homeowners. He works alongside our team to research specific investors or servicers and identify modification programs available to clients, achieving a success rate of over 99% in securing favorable outcomes for homeowners seeking loan modifications.

What Are Your Rights to a Loan Modification From Your Mortgage Lender or Loan Servicer?

There are powerful new regulations that have been promulgated by the Consumer Finance Protection Bureau (“CFPB”) under the Real Estate Settlement Procedures Act (“RESPA”) and the Truth in Lending Act (“TILA”) that give borrowers the right to sue when mortgage loan servicers fail to meet their servicing obligations. We can sue your lender if they violate these regulations.

What Are Some of the Most Common Modification Violations Made By Servicers?

Some of the most common modification violations made by servicers occur after they have violated one (or several) of the following regulations:

- Issue a decision within 30 business days of receipt of a complete application for a Loan Modification, Short Sale, or Deed in Lieu of Foreclosure.

- Advise the borrower within 5 business days after receipt of an application, if there are any additional documents needed.

- Stop any and all action in a foreclosure, while a complete application is being reviewed.

- Provide information properly requested about ownership of note and mortgage under TILA within 10 business days.

- Provide information properly requested about loan payments, loan history, and other loan information within 30 business days.

- Provide payoff or reinstatement figures within 7 business days of receipt of written request.

If a servicer violates these regulations, there can be liability under Regulations X and Z for statutory damages of $1000 to $4000, attorney fees, and compensatory damages (including emotional distress, legal fees, credit diminution and other losses).

What Are The Different Types of Loan Modifications?

A loan modification will restructure your mortgage by changing one or more of the payment terms. The type of modification available will depend upon the investor and servicer for your loan. Common types of loan modifications include:

- Principal Reduction Loan Modification – Forgives a portion of the principal loan amount.

- Principal Forbearance – Ignores a portion of the amount owed until the end of the loan term, or the sale of the property.

- Interest Rate Reduction Loan Modification – Reduces the loan interest rate.

- Loan Term Extension – Extends the life of the loan, reducing the monthly payments.

- Late Fee Forgiveness – Removes late fees accrued due to missed payments.

- Capitalization of Arrears – All missed payments and fees are added to the end of the loan.

Where Do You Provide Loan Modification Services?

Ira J. Metrick serves consumers and homeowners throughout the state of New Jersey from his Freehold NJ law office. They can assist with understanding loan modification options in all New Jersey counties.

- Atlantic County

- Bergen County

- Burlington County

- Camden County

- Cape May County

- Cumberland County

- Essex County

- Gloucester County

- Hudson County

- Hunterdon County

- Mercer County

- Middlesex County

- Monmouth County

- Morris County

- Ocean County

- Passaic County

- Salem County

- Somerset County

- Sussex County

- Union County

- Warren County

How Long Does the Loan Modification Process Take?

The Federal Rules say that your lender is required to review a “Complete Application” within 30 days of receipt. However, this rarely happens. It is more likely that your lender will continue to ask for the same documents and information and refuse to review the application.

After 30-60 days, the lender will likely say that your financial documents are “stale” and must be updated. That is why it is important to submit all the information in 1 package. It is also very important to keep copies of what was submitted and have proof of what was submitted and when it was received by the lender. If you submit everything and the lender asks for something else, it may be a good idea to re-submit the whole application with the new information so the lender has everything together. It is very common for lenders to “lose” documents or not be able to find the original package when new information is submitted.

The lenders make more money every day the loan is in default, so they do not have any incentive to help homeowners. You must keep good records, so you can go to a Judge and show that you have been doing your part and the lender has been failing to meet its obligations.

Can I Apply for a Loan Modification if I am Currently Unemployed?

Yes, you can apply for a loan modification even if you’re currently unemployed. Some Lenders consider unemployment as a valid financial hardship and accept evidence of your unemployment benefits to make payments. However, some Lenders will not approve a modification if you are unemployed, because the benefits are temporary.

Will a Loan Modification Stop Foreclosure?

Yes, obtaining a loan modification can halt foreclosure proceedings. Once your lender acknowledges that you have submitted a “complete Application” for a loan modification, they should pause the foreclosure process to evaluate your application. If approved, the loan modification terms will replace the original mortgage terms, and foreclosure proceedings should stop as long as you continue to make the payments. If you receive a Temporary (Trial) Modification, it is advised to continue making those payments until you are advised, in writing, to stop. Do not stop making payments.

Can I Appeal a Loan Modification Denial?

Yes, if your loan modification request is denied, you have the right to appeal. The first step is to review the denial letter from your lender, which should outline the reasons for the denial and provide information on the appeal process.

You cannot submit new information to show additional income as part of the appeal. That would require a new application. The purpose of an appeal is to show them that they made a mistake in the review of the information that was submitted.

Engaging a legal professional can improve your chances during the appeal process.

Can I Get a Loan Modification If My Mortgage is Underwater?

Yes, homeowners with underwater mortgages, where the remaining mortgage balance exceeds the home’s current value, can still apply for and receive a loan modification. Lenders often consider loan modifications for underwater mortgages as it can be a more favorable alternative to foreclosure. Each lender has its criteria, but the key is to demonstrate financial hardship and the ability to make modified payments.

What Documents Do I Need to Apply for a Loan Modification?

When applying for a loan modification, it’s essential to provide all of the relevant information in one package to support your application. The documents usually required include:

● Proof of income: This can be recent pay stubs, tax returns, or other financial statements that demonstrate your earnings.

● Explanation of financial hardship: A written statement explaining the circumstances that have affected your ability to make regular mortgage payments.

● Recent bank statements: Usually, lenders ask for the last two to three months to assess your financial status.

● Details about monthly expenses: This helps lenders gauge your current financial obligations.

Submitting a complete and accurate application with all required documentation improves the chances of your loan modification request being approved.

If you need assistance with a New Jersey Loan Modification, contact the Law Office of Ira J. Metrick today.

What is a Loan Modification?

In New Jersey, a Loan Modification is a change made to the terms of an existing mortgage. Most commonly, modifications occur after a Borrower has fallen behind and the Lender has stopped accepting payments. The modification from the lender sets a new monthly payment amount and permits the Borrower to start making monthly payments and avoid Foreclosure.

Modifications do not always lower the monthly payments. If the total amount owed is more than the original loan amount, or if current interest rates are higher than the existing interest rate, the modification payment can be more than the original payment amount.

A Loan Modification is the best way for a homeowner to save their home after they have fallen behind on their mortgage payments.

Why Did My Lender Reject My Loan Modification?

Your Lender is required to give you a written explanation of why your modification application is denied. There are many reasons a lender might deny an application for a loan modification, including but not limited to:

- Insufficient finances to afford a modified payment.

- “Lack of hardship,” or ability to pay the current mortgage payments without issue.

- You have already received the maximum number of loan modifications the lender allows.

- You did not make 12 consecutive payments on the original loan or a loan modification.

- Failure to File Income Taxes.

- It is not possible to create a modification with a lower monthly payment.

- There are not at least 37 days prior to the Sheriff’s Sale.

However, it is common for Lenders to make errors in denying applications. A loan modification application cannot be denied because it is considered “Incomplete.”

At the law office of Ira J. Metrick, we can help you assess your options to defend a foreclosure and stay in your home. We offer aggressive representation in the modification process and we can also help you determine whether your lender improperly denied your application a modification.

How Can I Avoid Fake Loan Modification Companies?

In NJ, there has been an increase in the number of fraudulent companies claiming to offer services such as “loss mitigation consulting,” “foreclosure prevention,” and “mortgage loan modification.” They reach out to homeowners who have been served with foreclosure papers, saying that they can help, but the truth is that many of them lack the correct license and are not permitted to offer these services in New Jersey.

The New Jersey Department of Banking and Insurance receives complaints about these companies. Homeowners are advised to be cautious and only work with properly licensed companies and individuals within New Jersey to avoid falling prey to these scams.

Can I Be Denied a Loan Modification Due to a Title Issue in NJ?

In New Jersey, some homeowners face loan modification denials or cancellations due to alleged title issues, such as liens or judgments. Lenders often cite these issues as obstacles to providing a clear, marketable title, but this should not stop the modification process.

New Jersey law protects homeowners in these situations, ensuring that a modification, which adjusts the terms of the original mortgage, doesn’t lose its priority lien position. Lenders are not permitted to cancel modifications for such reasons, as the modification is an alteration of the existing mortgage, not a new agreement.

Is There a Fee for Applying for a Loan Modification?

No fee is typically charged by mortgage lenders or servicers for applying for a loan modification. However, fees may be incurred if employing the services of lawyers or third-party companies. In New Jersey, only licensed New Jersey Attorneys and state licensed Debt Adjusters are permitted to charge fees for modifications. Be wary of scams. Ask if they are licensed in New Jersey.

What Happens if I Miss a Payment During the Trial Modification Period

Missing a payment can endanger the modification agreement. Lenders consider the trial period a test of your payment reliability. Non-payment suggests potential future defaults, possibly leading to a denial of the permanent modification. However, read the agreement carefully. Many times the payment is due on the first of the month but will be accepted as long as it is received by the last day of that calendar month.

Can I Refinance My Home After a Loan Modification?

Refinancing post-modification is possible, but you should speak with a licensed mortgage broker to find out specific details for your situation.

Are There Special Loan Modification Programs for Veterans?

Veterans have access to specialized modification programs, especially with VA loans. These programs, offered by the VA, aim to help veterans avoid foreclosure by providing more favorable loan terms or reduced interest rates. However, there are limitations on when these options will be offered.

What's the Difference Between Loan Modification and Forbearance?

Loan modification permanently alters your loan terms to reduce payments, possibly changing the interest rate, balance, or term. Forbearance, conversely, temporarily reduces or suspends payments but does not alter the loan’s original terms. Additionally, at the end of the Forbearance, you will be expected to make up all of the missed payments.

Can I Apply for a Loan Modification More Than Once?

There is no limit to the number of times you can request a loan modification. However, the Federal protections only apply to one (1) application for each mortgage servicer. This means that every time the mortgage is transferred to a new servicer, you can submit a new application and receive the federal protections concerning a review and foreclosure protections. It is also possible that there is a limit to the number of times the loan may be modified. If a lender tells you that you reached the limit for the number of modifications, you should ask for a copy of the servicing guidelines that say there is a limit.

What Are the Possible Disadvantages of a Loan Modification?

The disadvantages of a loan modification include the possibility that: your interest rate can increase; your monthly payment can increase; it can take longer to pay the loan; and the total owed may even be more than your house is worth.

How Are Interest Rates Determined in a Loan Modification?

Interest rates are based upon the different modification programs. There is no guarantee that they will be reduced. Many times, the interest rate for a modification is based upon current market rates. So, if the market rate is higher than the original rate, the interest rate will go up.

What to Do if I'm Denied a Loan Modification Due to Incomplete Documentation?

If your application is denied or your file is closed because they say the application was “Incomplete” or “Missing Documents” immediately contact your lender for specifics on the missing documents. Resubmit a complete application with everything that has been requested. Make sure you keep a copy of the application and be sure you have proof it was received by your lender.

Is Loan Modification Possible on an Investment Property?

Loan modifications are available for investment properties, though they might have stricter requirements and less favorable terms compared to primary residences. Demonstrating financial hardship and the ability to meet modified payment terms is key for approval.