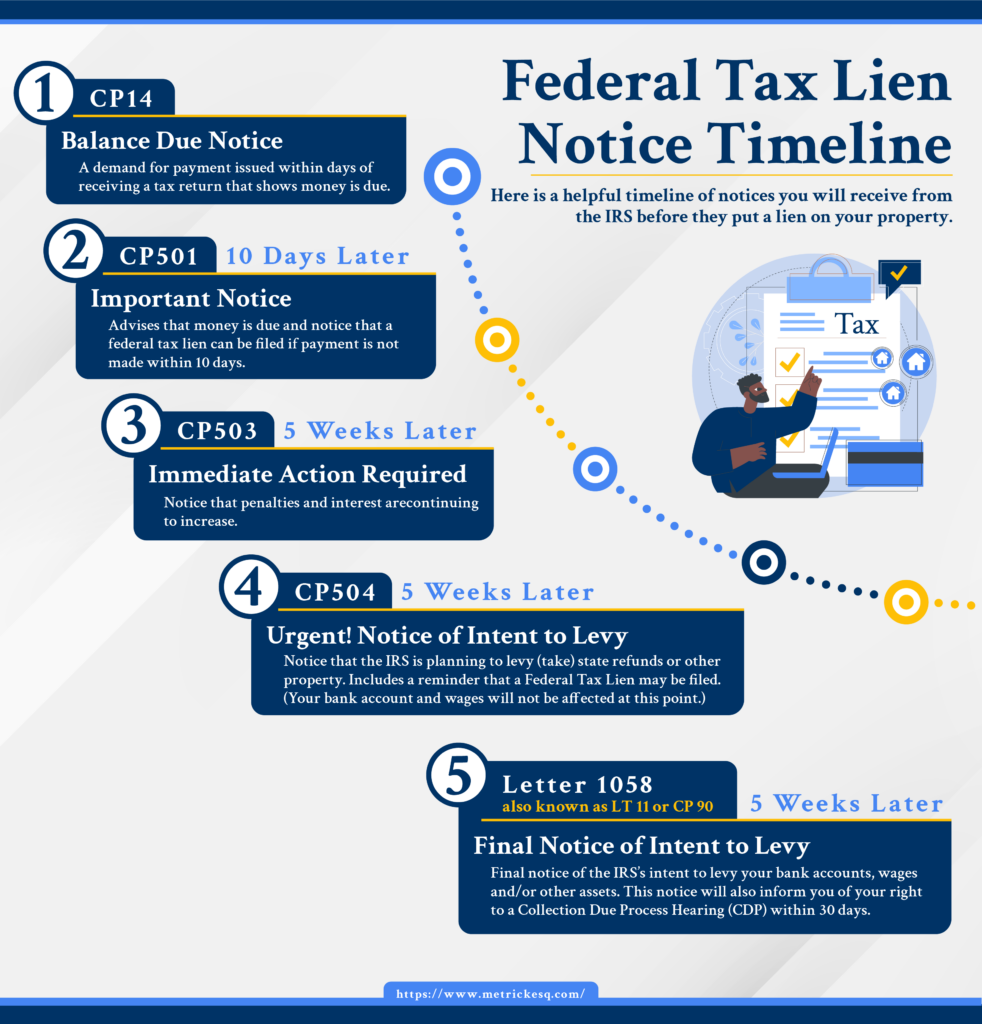

Click the Visual Timeline to Zoom in.

Although every case is different, below is a general timeline of the Federal Tax Lien Notice timeline:

Table of Contents

- What is a CP 14 Balance Due Notice?

- What is a CP 501 Important Notice?

- What Happens If I Ignore a CP 503 Immediate Action Required Notice?

- What is a CP 504 Urgent! Notice of Intent to Levy

- What is Letter 1058 (also known as “LT 11” or “CP 90”) Final Notice of Intent to Levy?

- When will I be able to request a Collection Due Process Hearing (CDP)?

- What if the Federal Tax Lien is Not Paid?

- What Are The Different Types of Tax Lien Resolutions and Services?

What is a CP 14 Balance Due Notice?

A CP 14 Balance Due Notice is a letter sent by the Internal Revenue Service (IRS) to taxpayers when they have an outstanding balance on their federal income tax return. This notice is usually the first communication from the IRS regarding unpaid taxes and serves as a notification that the taxpayer must address the balance due.

What is a CP 501 Important Notice?

A CP 501 Important Notice is a letter sent by the Internal Revenue Service (IRS) to taxpayers when they have a balance due on their federal income tax account. The CP 501 notice is a follow-up to the initial CP 14 Balance Due Notice, arriving approximately 10 days after, and serves as a reminder to the taxpayer that they still have an outstanding balance that needs to be addressed.

What Happens If I Ignore a CP 503 Immediate Action Required Notice?

Ignoring a CP 503 notice can lead to more severe consequences, such as a tax lien or levy on your property, wages, or bank accounts. If you are unsure about how to proceed, you may want to consult with a tax professional to help you navigate the situation and determine the best course of action.

What is a CP 504 Urgent! Notice of Intent to Levy

Arriving approximately 5 weeks after CP 503, a CP 504 Urgent! Notice of Intent to Levy is a letter sent by the Internal Revenue Service (IRS) to taxpayers in the United States who have an outstanding balance on their federal income tax account. The CP 504 notice is an urgent warning that comes after previous notices (CP 14, CP 501, and CP 503) have been sent and ignored. It indicates that the IRS is planning to levy (take) state refunds or other property if the balance is not addressed.

What is Letter 1058 (also known as “LT 11” or “CP 90”) Final Notice of Intent to Levy?

Letter 1058 is a Final Notice of Intent to Levy sent by the Internal Revenue Service (IRS) to taxpayers in the United States who have an outstanding balance on their federal income tax account. This notice is a last warning that comes after previous notices (CP 14, CP 501, CP 503, and CP 504) have been sent and ignored. The letter informs the taxpayer that the IRS intends to take collection action in the form of a levy if the outstanding balance is not addressed within 30 days.

When will I be able to request a Collection Due Process Hearing (CDP)?

You will also be notified of your right to request a Collection Due Process Hearing (CDP) within 30 days. If this hearing is requested within this time frame, there will be no levy until the process has concluded. Additionally, you will also have the right to have the US Tax Court review the decision if you do not agree with it.

Please note that if the request for the hearing is made AFTER 30 days, you may still be entitled to an equivalent hearing, but you will lose the right to the US Tax Court Review if you disagree with the outcome and the IRS may levy your assets while you await your hearing. This means you would be forced to pay the tax in full and then fight to get it refunded.

What if the Federal Tax Lien is Not Paid?

If the Federal Tax Lien is not paid; or if a hearing is not timely requested; or if some other payment arrangements are not made (such as an Installment Agreement (IA) or Offer in Compromise (OIC)), the IRS can take collection actions against your property, or rights to property.

A “levy” is to get cash from a bank account, investment account, or wages, while “seizure” is the act of taking property, such as cars, jewelry, real estate or other valuable assets.

These include:

- Wages

- Social security benefits

- Real estate

- Automobiles

- Business assets

- Bank accounts

- Accounts receivable

- Any other income

What Are The Different Types of Tax Lien Resolutions and Services?

Offers in Compromise (OIC)

An offer in compromise is an agreement with the IRS that settles your liabilities for less than the full amount owed. Note that this option is usually only available to those who cannot repay their debts through another method, such as installments.

Installment Agreements (IA)

Installment agreements are payment plans for the IRS that allow you to pay the taxes you owe within a designated period of time.

Penalty Abatement

A penalty abatement is when the IRS waives a portion (or all) of a penalty if the taxpayer can qualify for a First Time Penalty Abatement or show reasonable cause for failing to fulfill their tax obligations.

Innocent Spouse Relief

Innocent Spouse Relief can protect you from additional taxes that you owe due to your spouse failing to report income correctly (or at all.)

Payroll Taxes / Trust Fund Recovery Penalty (TFRP)

A trust fund recovery penalty is a fine against an employer, or other company representative, who has the responsibility to pay employees and submit the proper taxes to the IRS. This can be for an employee’s income taxes or Federal Insurance Contributions Act (FICA).