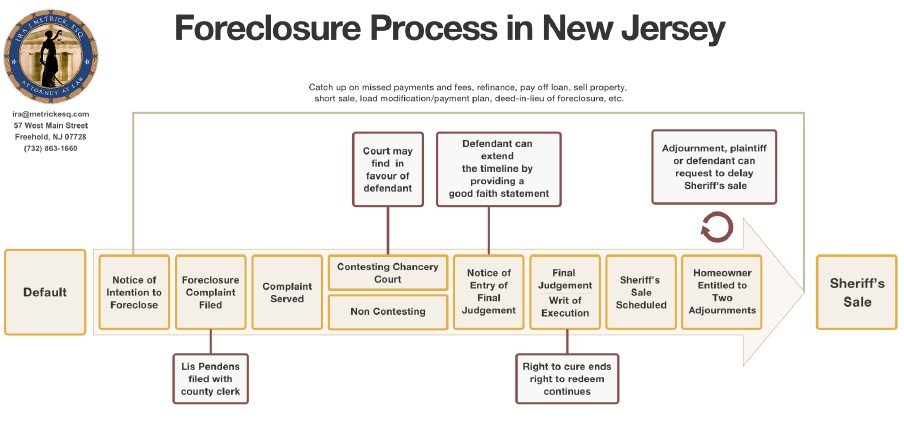

If you are facing foreclosure in New Jersey, it is critical that you understand the steps in the process. Keeping track of deadlines and answering your mail in a timely manner can be the difference between staying in your home or not. Below is a timeline of the major steps in a New Jersey foreclosure.

Foreclosure Defense

[2023 Update] NJ Foreclosure Timeline Overview

Although every foreclosure case is different, below are the general steps in the timeline of foreclosure in New Jersey.

Table of Contents

Show Table of Contents

- Default

- Notice of Intent to Foreclose

- Lis Pendens Filed With the County Clerk.

- Complaint Served

- File an Answer

- If the Homeowner Can Prove the Plaintiff Does Not Have the Right to Foreclose

- If the Lender Can Show That They Have the Right to Foreclose

- Notice of Motion for Entry of Final Judgment

- Final Judgment and Writ of Execution

- Sheriff Sale is Scheduled.

- The Homeowner is Entitled to Two Adjournments

- The Sheriff Sale Takes Place

Default

The homeowner defaults on their mortgage payments. The lender or servicing company can begin the foreclosure process once there are past due payments.

Notice of Intent to Foreclose

The homeowner receives a Notice of Intent to Foreclose from their lender or servicer, giving them a final chance to reinstate their mortgage and get back on track with payments before the lender files the Foreclosure Complaint.

- The lender must provide at least 30 days for the homeowner to make this payment before the complaint can be filed.

Lis Pendens Filed With the County Clerk.

The public Foreclosure Complaint is filed, and Lis Pendens is filed with the county clerk.

- Once this document is filed, the homeowner will start to receive advertisements from various parties offering assistance in the foreclosure process. It is important to be sure that assistance is coming from a reliable source. IT MAY BE A FORECLOSURE SCAM IF:

- The company is not located in NJ;

- The company does not have a NJ licensed attorney that you can speak with;

- You get a notice that looks like it came from the Government with a number to call;

- They tell you that you are about to lose your home;

- You cannot speak to the attorney that is handling your file;

- They require you to file the papers with the Court; or

- They will not appear in Court to defend you

Complaint Served

The homeowner is personally served with the complaint. If service fails for whatever reason, the lender will serve the complaint by mail or by publishing in a local newspaper.

File an Answer

The homeowner may file an answer to the complaint in Chancery Court – contesting or non-contesting. To properly defend themselves, they must file a contesting answer to the foreclosure complaint within 35 days of being served the complaint. A contesting Answer is one that disputes the Lender’s right to foreclose. If the homeowner files a contesting answer, the Court will issue a scheduling Order to allow for Discovery and possibly a Trial.

If the Homeowner Can Prove the Plaintiff Does Not Have the Right to Foreclose

If the Homeowner can prove the Plaintiff does not have the right to foreclose, the Complaint can be dismissed. It is increasingly difficult to get Complaints dismissed. If a Complaint is dismissed, it is normally, “without prejudice.” This means that the lender can fix whatever mistakes were made and file a new Complaint. If a Complaint is dismissed “with prejudice” it means that the lender cannot file a new complaint and the property cannot be foreclosed. This is very rare. If the case can be dismissed, it should be evaluated to see if there are any claims that can be brought against the Lender or the Attorneys for improper actions.

If the Lender Can Show That They Have the Right to Foreclose

If the Lender can show that they have the right to foreclose through a Motion to Strike the Answer, Motion for Summary Judgment, or at a trial, the litigation is over and the Lender can move towards a Sheriff Sale. The homeowner then receives a Notice of a Right to Cure, which gives one more chance to reinstate the loan and avoid foreclosure. At this point, the homeowner can extend the timeline by providing a good faith statement which says that they have a reasonable probability of obtaining the funds needed to reinstate the loan.

Notice of Motion for Entry of Final Judgment

If the funds are not paid to reinstate, the Homeowner will receive a Notice of Motion for Entry of Final Judgment, which means the lender is asking the court to set the exact amount owed so they can schedule a Sheriff Sale. At this point, the homeowner can object to the amount due by showing proof that the Lender’s figures are wrong.

Final Judgment and Writ of Execution

The lender obtains Final Judgment and Writ of Execution. The lender is no longer required to let the homeowner reinstate the mortgage. However, in many cases they will still allow reinstatement. But the homeowner still has options.

- The homeowner can still apply for a loan modification after final judgment, as long as a complete application is submitted at least thirty-seven (37) days prior to the Sheriff Sale. For the most protections, the Modification Application should be submitted at least forty-five (45) days before the Sheriff sale.

Sheriff Sale is Scheduled.

The Sheriff Sale is scheduled. The amount of time between the lender applying for a sheriff sale and the date of the sale can vary depending on how busy the County’s schedule is.

The Homeowner is Entitled to Two Adjournments

The homeowner is entitled to two Adjournments of up to 30 days to delay the sale.

The Sheriff Sale Takes Place

The Sheriff Sale takes place. This is the final stage in the foreclosure process. Once the sheriff sale is complete, the new owner will need to obtain a Writ of Possession or Order for Ejectment, in order to make the homeowner leave the property. They cannot simply lock them out of the house.

- Learn more about Eviction after Foreclosure here. Also, be aware that you will still be responsible for taxes, bills, and other costs after a sheriff sale.

Representation for Simple & Complex Foreclosure Defense Cases in NJ

Foreclosure defense can be simple. Many people are not looking to fight. They understand that they missed payments and would rather use their resources to try to fix the situation. They may have experienced financial hardships and just need time to make a plan. They seek an attorney to represent them to confirm that the lender that is trying to foreclose has the proper proofs. They also want an attorney to be available throughout the process to answer questions and explain each step, without extensive legal fees and litigation. For these homeowners, I offer a fixed fee to Answer the Foreclosure Complaint and conduct discovery to determine if the lender has the proof that will be accepted by the Court. If we believe that the lender will prevail in Court, we settle the case to get as much time as possible, and I stay on the case to receive and explain all notices, so that my clients understand what will happen and how much time they have. If we find a defect in the lender’s case, we discuss whether it makes sense to invest in a fight.

Understanding the Complexity of Foreclosure Defense and Litigation

Foreclosure defense can also be complex. There are situations where the lender does not have the right to foreclose and it is necessary to fight in Court. These types of cases include, but are not limited to, situations where the homeowner was making payments under a loan modification, or the lender does not have a recorded Assignment of Mortgage. I generally avoid Predatory Lending claims. In cases where litigation is necessary, a homeowner needs to be prepared for significant legal fees based upon hourly billing. Time must be spent to prepare specific defenses and Counterclaims in response to the Complaint. If a claim is not described properly, it is at risk of being dismissed. Depending upon the defense, depositions could be required. After that, there will likely be a Motion by the lender to Strike the Answer or to obtain Summary Judgment. To defend the motion and file a cross Motion to Dismiss the Complaint requires several hours of attorney time. If the lender’s motion can be defeated, the next step is a Trial where the lender must produce a witness to testify as to why the lender has the right to foreclose. Trials take several hours of preparation and can last for more than one day. I offer representation for these types of cases, when the homeowner understands the costs and risks and I believe I can succeed in Court based upon the claims.

Can My Foreclosure Be Dismissed?

In all of my cases, I am trying to find defects and get the Foreclosure Complaint dismissed. If we can get the foreclosure complaint dismissed, I evaluate the case to see if there are claims that could be brought in Federal Court. In many cases where we can get the complaint dismissed, I offer to represent the homeowner to file a Federal Complaint under the Fair Debt Collections Practices Act (FDCPA). I am also reviewing my cases to see if there are any claims related to the loan, which may be brought against the Lender or their Attorneys, under:

- Truth in Lending Act (TILA)

- Real Estate Settlement Protection Act (RESPA)

- New Jersey Consumer Fraud Act (NJCFA)

- Fair Debt Collection Practices Act (FDCPA)

When there is an issue or concern about RESPA or TILA or the NJCFA, or the case is complex, we have a valuable resource for our clients. Dann Law is a multi-state law firm that has a focus on RESPA and TILA. Many of our clients have been represented by Dann Law in Federal Actions against the lender or their attorneys, and I have Co-Counselled cases with them. Javier Merino, Esq. is the Partner of Dann Law responsible for NJ. You can view their information and some of our successes here.

Mortgage Foreclosure Defense in New Jersey

MANY MORTGAGE FORECLOSURES CONTAIN VIOLATIONS OF FEDERAL STATUTES. MANY LOAN MODIFICATION REVIEWS AND DENIALS CONTAIN VIOLATIONS OF FEDERAL STATUTES.

We are a cutting edge and aggressive Foreclosure Defense and Mortgage Loan Modification Law Firm that can obtain a full Securitization report of your loan documents that shows who has the right to enforce your note. We can also use that information to determine what Modification Programs apply to your loan. HAMP is over, so it is important to know what information will be used when your lender reviews your modification application.

It doesn’t matter what stage of the Foreclosure process you are in – we can help! Do not sit back and be defensive, get on the offensive. If we can uncover fraud and violations of federal law, it is possible to file Federal Complaints against the lenders. We have defenses, counterclaims and processes that can help clients fight the bank’s actions in foreclosure. Every case is different and I cannot guarantee any type of result, but you owe it to yourself to at least “investigate” by contacting me.

Facing Foreclosure in NJ? Let’s Determine the Best Plan For You

Did You Know…

- We Can Bring Counterclaims Against Your Lender in State Court and bring a separate action in Federal Court, for Violations by your Servicer!

- You can bring actions against your Servicer for violations of the new amendments to TILA and RESPA! (Reg X and Reg Z)

- You can bring actions against your Servicer for failing to properly review your Loan Modification Application!

- You can bring Federal Actions against your Lender and their attorneys if the sell your home at sheriff sale while you are being reviewed for a modification.

- You can file a motion with the Court to get time before a sale to be reviewed for a modification.

- In some circumstances, you can file a motion with the Court to force the lender to review you modification application, AFTER a sheriff sale.

- While We Fight Your Foreclosure in State Court. We can also review your lenders actions to determine if there are federal violations.

- We can Facilitate a Consumer Federal Protection Bureau (CFPB) Complaint, when your Servicer violates your rights!

Learn more about common mortgage servicing companies who foreclose.

Learn more about the newer NJ foreclosure laws.

Your Case is Unique and I Will Give You the Personal Attention That You Deserve

Many homeowners that come to us have already made assumptions as to what type of relief they are seeking without actually knowing what is available to them. Since HAMP is over, there are many modification programs available, regardless of how long it’s been since a payment was made or how far the property is underwater. There are many lenders that are offering modifications based upon the current property value, without looking at income. The reality is that every case is different and many homeowners’ best solution is one that they may not have thought of. We want to strongly urge homeowners to take action because ignoring the problem will only make the situation worse. If you are late on your mortgage or you foresee that you might be approaching default, call us so that we can educate you on your options. We see too many homeowners that could have saved their homes if they just would have contacted us sooner about foreclosure defense. Don’t let that happen to you!

Foreclosure Defense is Changing Every Day

Did you know that a Federal Complaint can be brought against your lender and their attorneys if they violate the protections contained in the “Fair Debt Collection Practices Act” and the New Jersey Consumer Fraud Act? We are dedicated to staying current on tools, programs and new case law that is emerging all of the time.

Stay in Your Home While I Defend Your Foreclosure Case

I am an experienced foreclosure defense attorney who can get results. The threat of losing your home can take a toll on you and your family no matter what stage of the foreclosure process you are in. The most important thing for you to do to protect yourself and your family is to retain an experienced New Jersey licensed attorney.

Step 1: Reach Out to Me For the Solution

Learn more about the NJ Foreclosure Timeline

When you reach out to us by filling the form out on the right of this page, you will receive an IMMEDIATE response back from me. The first step of “Reaching Out” is the most important part of the process. As you can see by the foreclosure timeline above, the longer you put off this step the worse your situation will get – preventing you from taking advantage of certain programs and defenses.

I Can Get Results At An Affordable Price

We feel that it is our DUTY to educate and consult any homeowner that reaches out to us for help. There is never a charge or fee for an initial consultation. We made it our mission to help New Jersey homeowners that are facing Foreclosure or having trouble paying their mortgages. Our mission to protect homeowners shows in our record and through the clients that my firm has helped.

What Happens First?

As soon as you reach out to us by filling the form out on the right of this page, I will personally contact you. Most homeowners are surprised that I personally handle their cases. They are also surprised how affordable it can be to defend them against the foreclosing lender. When you speak to me during the initial free foreclosure defense consultation, these are my goals:

- Get to know you and identify your immediate needs

- Listen to your story and assess your personal situation

- Identify exactly where you are in the process

- Discuss your desired options (Loan Modification, Stay In Your Home, Short Sale, Etc)

- Lay out a “Plan Of Attack”

As part of the initial consultation with clients, I always try to find out the “goal.”