When personal, business, employment or payroll taxes are not paid, the IRS can file a Federal Tax Lien against an Individual or a Business. The liens will also carry interest and penalties and it can be a difficult situation to resolve. At the office of Ira J. Metrick in Freehold, NJ, we can assist you with federal tax lien resolution.

Federal Tax Lien Resolution Services

The Law Office of Ira J. Metrick Seeks Tax Lien Resolutions For You

Contrary to popular belief, the IRS is not always “the bad guy.” In fact, the IRS is willing to compromise and work with individuals to resolve liens. Our office can represent you in negotiations with the IRS to find a federal tax lien resolution that works for both parties.

We begin by conducting a thorough analysis of your financial situation to determine what you can afford to pay. We also examine the taxes, interest, and penalties to identify any amounts that can be eliminated based on the Statute of Limitations, Penalty Abatements, or other reasons, such as not owing the taxes. If you are eligible, we can help you apply for a loan Offer in Compromise, which allows you to pay less than the total amount owed. Alternatively, we may be able to secure an Installment Agreement, which permits you to pay off the lien over several months.

Note that the Installment Agreement option is typically only available to those who cannot repay their debts through other means, such as in installments. Moreover, the Offer in Compromise process involves two hurdles: qualifying to apply and getting the IRS to accept your offer. Fortunately, the IRS provides an online tool to help you determine your eligibility.

Achieving Tax Relief through Offer in Compromise

You may also be eligible for a loan Offer in Compromise, which allows you to pay less than the total owed. Note that this option is usually only available to those who cannot repay their debts through another method. Additionally, there are two hurdles in the Offer in Compromise process: qualifying to apply and getting the IRS to accept your offer. Thankfully, the IRS has an online tool to help you determine if you might be eligible.

Once you submit your application and supporting documentation, the IRS will evaluate your financial situation to determine whether you qualify for the program. If your offer is accepted, you will need to make a lump sum payment or establish a payment plan to pay the agreed-upon amount.

On this page, you will find additional resources and helpful information regarding federal tax liens and what we can do for you in terms of IRS tax lien release.

What is a Federal Tax Lien?

A federal tax lien, also called an IRS lien, is a legal claim to your property created when the IRS assesses a tax debt. Even though the lien may not be recorded with the County to put the public on notice, once the a tax debt is assessed, the IRS has an “Invisible Lien.”

The IRS may file a physical Notice of Federal Tax Lien at any time to protect the government’s interests. The Notice of Federal Tax Lien puts the world on notice that the government has a right to your assets, including any assets you acquire after the lien is filed. A lien can be filed even if a hearing is requested to contest the amount the IRS claims is due. (It is possible to stop a lien, or have it removed if you reach an agreement with the IRS for payment.)

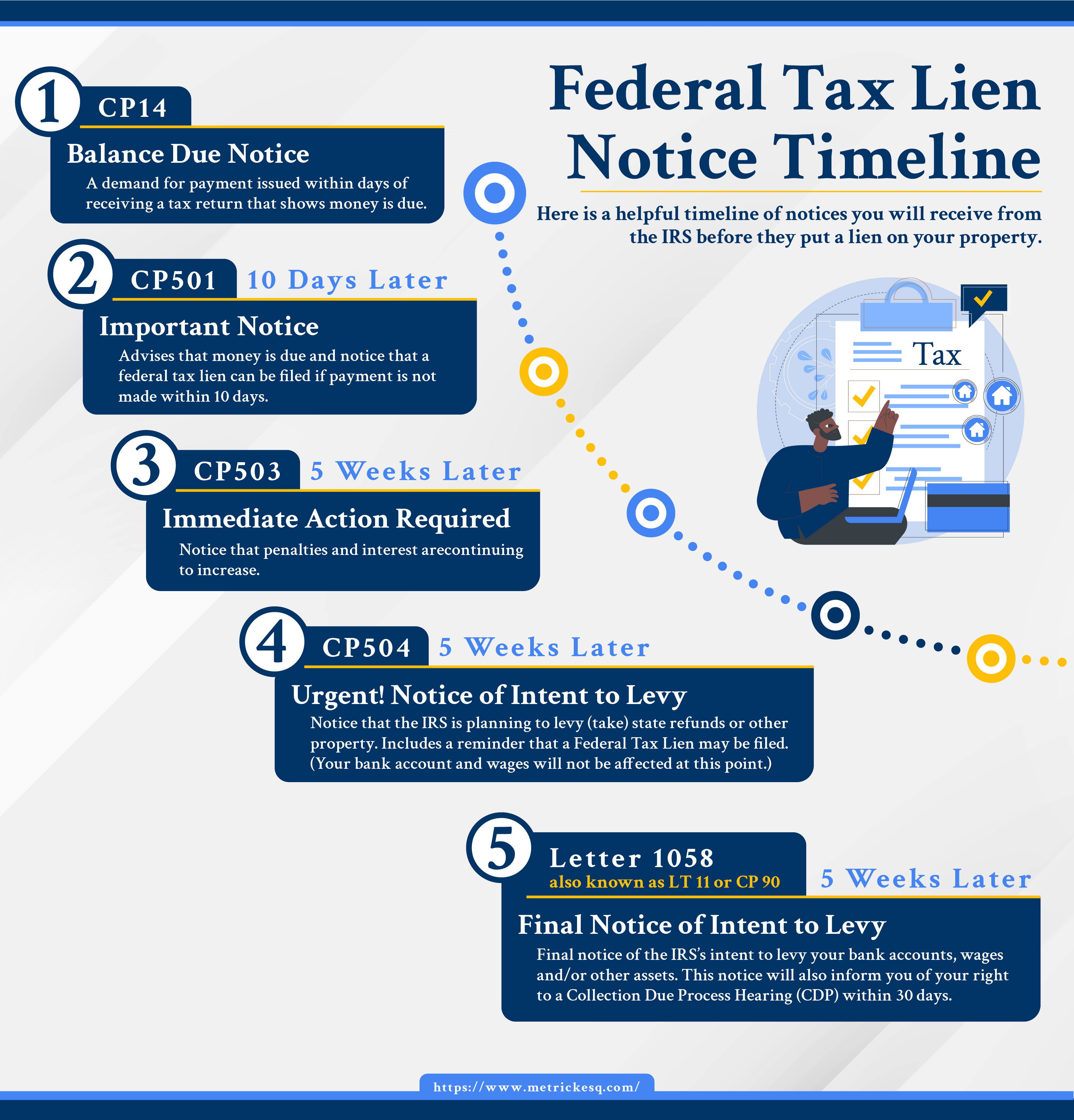

Federal Tax Lien Important Notices Timeline

- CP 14 Balance Due Notice – A demand for payment that is issued within a few days of receiving a tax return that shows money is due.

- CP 501 Important Notice – Arrives approximately 10 days after CP14. Advises that money is due and notice that a federal tax lien can be filed if payment is not made within 10 days.

- CP 503 Immediate Action Required – Arrives approximately 5 weeks after CP 501. Notice that penalties and interest are continuing to increase.

- CP 504 Urgent! Notice of Intent to Levy – Arrives approximately 5 weeks after CP 503. Notice that the IRS is planning to levy (take) state refunds or other property. There is also a reminder that a Federal Tax Lien may be filed. (Your bank account and wages will not be affected at this point.)

- Letter 1058 (also known as LT 11 or CP 90) Final Notice of Intent to Levy – Arriving approximately 5 weeks after CP 504, it is notice of the IRS’s intent to levy your bank accounts, wages and/or other assets.

Navigating Collection Due Process Hearings Following Tax Lien Notices

You will also be notified of your right to request a Collection Due Process Hearing (CDP) within 30 days. If this hearing is requested within this time frame, there will be no levy until the process has concluded. Additionally, you will also have the right to have the US Tax Court review the decision if you do not agree with it.

Please note that if the request for the hearing is made AFTER 30 days, you may still be entitled to an equivalent hearing, but you will lose the right to the US Tax Court Review if you disagree with the outcome and the IRS may levy your assets while you await your hearing. This means you would be forced to pay the tax in full and then fight to get it refunded.

Levy/Seizure Based on Federal Tax Liens

If the Federal Tax Lien is not paid; or if a hearing is not timely requested; or if some other payment arrangements are not made (such as an Installment Agreement (IA) or Offer in Compromise (OIC)), the IRS can take collection actions against your property, or rights to property, including:

- Wages

- Social security benefits

- Real estate

- Automobiles

- Business assets

- Bank accounts

- Accounts receivable

- Any other income

What Is A Levy/Seizure?

A levy is to get cash from a bank account, investment account, or wages, while seizure is the act of taking property, such as cars, jewelry, real estate, or other valuable assets.

Once the levy is served on the financial institution, the funds must be held for 21 days to allow time to argue that it should not occur.