New Jersey Foreclosure Facts – Fighting Foreclosure In Court

Many homeowners view the filing of a foreclosure complaint as the end of a dispute with their lender. Really, it is only the beginning. During the housing and refinancing bubble of the last decade, many mortgage loans were sold over and over again, often creating gaps in ownership that make foreclosure difficult or impossible. Loan servicers routinely violate federal and state laws and their fiduciary duties to lenders and homeowners. I have successfully raised these issues on behalf of homeowners resulting in dismissals of foreclosure complaints or modifications that make it possible for homeowners to remain in their home.

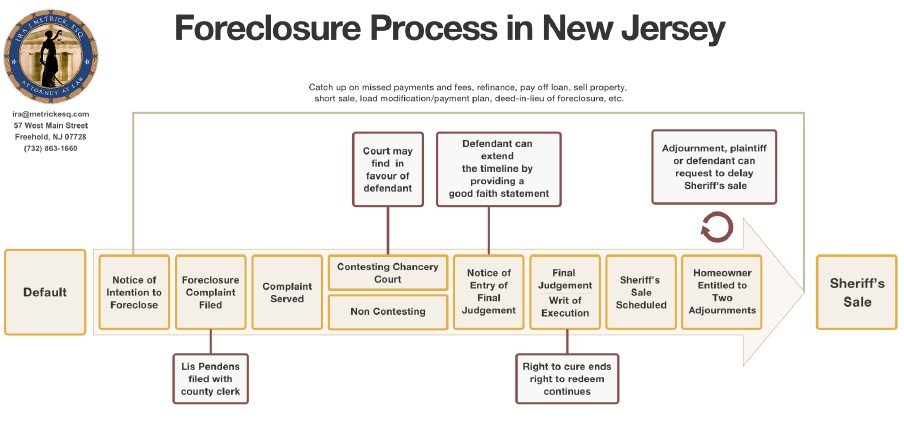

Click image below to zoom

Foreclosure is a “process” and not what people see on TV where a banker comes and takes their belongings and throws them out of the house. The chart above describes the general foreclosure process in the state of New Jersey. This is the framework in which I work. Depending upon your individual case, the timeline can last much, much longer as I fight for you in court and you stay in your home.

Does Declaring Bankruptcy Stop Foreclosure in NJ?

My office is a debt relief agency devoted to protecting the rights of New Jersey consumers. I offer representation for individual consumers in Chapter 13 and Chapter 7 bankruptcy cases. I aggressively pursue claims against any creditors and collection agents who fail to comply with the rules and regulations designed to protect you and your rights. Bankruptcy can be a wonderful and effective tool for homeowners in foreclosure.

What Is A Short Sale?

A short sale is when the lender will accept less than the amount owed in order for you to sell your home. This is a good strategy to avoid foreclosure if your intent is to exit your home. However, having a good Realtor is not enough. You also need to have a good Foreclosure Defense Attorney defending the foreclosure while working out a solution for a short payoff with the bank. See more on Short Sales in he “Experience” section of this site. You must understand that a short sale can be rejected by your lender, and you need to know how to protect your rights if this happens.

“You Are The Homeowner. You Have Rights.”

Remember This: You Own Your Home, Not Your Lender.

When your lender files for foreclosure, you instantly have an adversarial relationship. They are trying to collect a debt and they are pursuing you via the legal system. Don’t make the mistake of going to your lender and asking them how you should handle the situation. You need representation. Foreclosure defense is not just for the wealthy. Most of our clients are surprised how affordable it really can be.