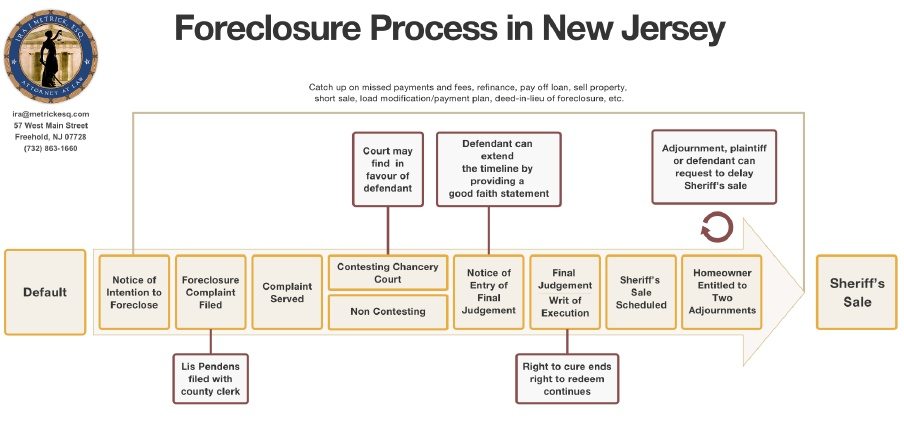

If you are facing foreclosure in New Jersey, it is critical that you understand the steps in the foreclosure process and timeline. Keeping track of deadlines and answering your mail in a timely manner can be the difference between staying in your home or not. Below is a timeline of the major steps in a New Jersey foreclosure.

NJ Foreclosure Timeline & FAQs

Understanding the Foreclosure Process Timeline in New Jersey

Here is a simple timeline explaining the NJ Foreclosure process. Although every foreclosure is different these are the general steps to Foreclosure in New Jersey. Understanding where you are at in the New Jersey foreclosure process and timeline is key to avoiding foreclosure and saving your home.

Table of Contents

Show Table of Contents

- What is Foreclosure?

- Default on Mortgage Payments

- Notice of Intent to Foreclose Mailed to Homeowner

- Lis Pendens Filed With the County Clerk

- Complaint Served

- File an Answer to the Complaint

- If the Homeowner Can Prove the Plaintiff Does Not Have the Right to Foreclose

- If the Lender Can Show That They Have the Right to Foreclose

- Notice of Motion for Entry of Final Judgment

- Final Judgment and Writ of Execution

- Sheriff Sale is Scheduled

- The Homeowner is Entitled to Two Adjournments

- The Sheriff Sale Takes Place

- My mortgage lender is sending me letters about foreclosure. What should I do?

- I am behind or late on my mortgage payments, or fear I soon will be. What should I do?

- I can no longer make my mortgage payments. Should I walk away from my house?

- How long can I stay in my foreclosed home?

- Does Declaring Bankruptcy Stop Foreclosure in NJ?

- What Is A Short Sale?

What is Foreclosure?

Foreclosure is the process by which your mortgage lender legally takes possession of the mortgage property for failure to pay or keep up with mortgage payments. The foreclosure timeline varies depending upon the state you live in.

Default on Mortgage Payments

The homeowner defaults on their mortgage payments. The lender or servicing company can begin the foreclosure process once there are past due payments.

Notice of Intent to Foreclose Mailed to Homeowner

The homeowner receives a Notice of Intent to Foreclose from their lender or servicer, giving them a final chance to reinstate their mortgage and get back on track with payments before the lender files the Foreclosure Complaint.

- The lender must provide at least 30 days for the homeowner to make this payment before the complaint can be filed.

Lis Pendens Filed With the County Clerk

The public Foreclosure Complaint is filed, and Lis Pendens is filed with the county clerk.

- Once this document is filed, the homeowner will start to receive advertisements from various parties offering assistance in the foreclosure process. It is important to be sure that assistance is coming from a reliable source. IT MAY BE A FORECLOSURE SCAM IF:

- The company is not located in NJ;

- The company does not have a NJ licensed attorney that you can speak with;

- You get a notice that looks like it came from the Government with a number to call;

- They tell you that you are about to lose your home;

- You cannot speak to the attorney that is handling your file;

- They require you to file the papers with the Court; or

- They will not appear in Court to defend you

Complaint Served

The homeowner is personally served with the complaint. If service fails for whatever reason, the lender will serve the complaint by mail or by publishing in a local newspaper.

File an Answer to the Complaint

The homeowner may file an answer to the complaint in Chancery Court – contesting or non-contesting. To properly defend themselves, they must file a contesting answer to the foreclosure complaint within 35 days of being served the complaint. A contesting Answer is one that disputes the Lender’s right to foreclose. If the homeowner files a contesting answer, the Court will issue a scheduling Order to allow for Discovery and possibly a Trial.

If the Homeowner Can Prove the Plaintiff Does Not Have the Right to Foreclose

If the Homeowner can prove the Plaintiff does not have the right to foreclose, the Complaint can be dismissed. It is increasingly difficult to get Complaints dismissed. If a Complaint is dismissed, it is normally, “without prejudice.” This means that the lender can fix whatever mistakes were made and file a new Complaint. If a Complaint is dismissed “with prejudice” it means that the lender cannot file a new complaint and the property cannot be foreclosed. This is very rare. If the case can be dismissed, it should be evaluated to see if there are any claims that can be brought against the Lender or the Attorneys for improper actions.

If the Lender Can Show That They Have the Right to Foreclose

If the Lender can show that they have the right to foreclose through a Motion to Strike the Answer, Motion for Summary Judgment, or at a trial, the litigation is over and the Lender can move towards a Sheriff Sale. The homeowner then receives a Notice of a Right to Cure, which gives one more chance to reinstate the loan and avoid foreclosure. At this point, the homeowner can extend the timeline by providing a good faith statement which says that they have a reasonable probability of obtaining the funds needed to reinstate the loan.

Notice of Motion for Entry of Final Judgment

If the funds are not paid to reinstate, the Homeowner will receive a Notice of Motion for Entry of Final Judgment, which means the lender is asking the court to set the exact amount owed so they can schedule a Sheriff Sale. At this point, the homeowner can object to the amount due by showing proof that the Lender’s figures are wrong.

Final Judgment and Writ of Execution

The lender obtains Final Judgment and Writ of Execution. The lender is no longer required to let the homeowner reinstate the mortgage. However, in many cases they will still allow reinstatement. But the homeowner still has options.

- The homeowner can still apply for a loan modification after final judgment, as long as a complete application is submitted at least thirty-seven (37) days prior to the Sheriff Sale. For the most protections, the Modification Application should be submitted at least forty-five (45) days before the Sheriff sale.

Sheriff Sale is Scheduled

The Sheriff Sale is scheduled. The amount of time between the lender applying for a sheriff sale and the date of the sale can vary depending on how busy the County’s schedule is.

The Homeowner is Entitled to Two Adjournments

The homeowner is entitled to two Adjournments of up to 30 days to delay the sale.

The Sheriff Sale Takes Place

The Sheriff Sale takes place. This is the final stage in the foreclosure process. Once the sheriff sale is complete, the new owner will need to obtain a Writ of Possession or Order for Ejectment, in order to make the homeowner leave the property. They cannot simply lock them out of the house.

- Learn more about Eviction after Foreclosure here. Also, be aware that you will still be responsible for taxes, bills, and other costs after a sheriff sale.

My mortgage lender is sending me letters about foreclosure. What should I do?

Some of these letters are known as Notices of Default (NOD), and a lender typically sends them out when a borrower is three months behind on their mortgage payments. A NOD means that you are in violation of your contract, and have a certain amount of time to correct the violation. When you get a letter like this, your first course of action should be to contact us or your mortgage company to see what options are available to you to avoid foreclosure. The sooner you do this, the better your chances will be.

I am behind or late on my mortgage payments, or fear I soon will be. What should I do?

Your first step should be to contact us right away to discuss your options, even if you haven’t missed a payment yet. We will be able to inform you of short term options to recoup after a couple of hard months, or long term options to alter the terms of your loan. It is better to be proactive about this than to wait for your lender to contact you with a notice of default.

I can no longer make my mortgage payments. Should I walk away from my house?

No, it is always preferable to seek other options to avoid foreclosure rather than walk away from your home. If you can no longer pay your mortgage and want to leave, contact us to see if you are eligible for a Short Sale (where you are permitted to sell your home for less than your remaining mortgage) or a Deed in lieu of Foreclosure or Mortgage Release (where you can surrender your property to your lender in exchange for forgiving the remaining debt.)

How long can I stay in my foreclosed home?

Once your home has been foreclosed upon, your lender will quickly begin the eviction process. Your right to stay in the foreclosed home will depend on local laws. Contact us as soon as possible to learn about your options.

Does Declaring Bankruptcy Stop Foreclosure in NJ?

My office is a debt relief agency devoted to protecting the rights of New Jersey consumers. I offer representation for individual consumers in Chapter 13 and Chapter 7 bankruptcy cases. I aggressively pursue claims against any creditors and collection agents who fail to comply with the rules and regulations designed to protect you and your rights. Bankruptcy can be a wonderful and effective tool for homeowners in foreclosure.

What Is A Short Sale?

A short sale is when the lender will accept less than the amount owed in order for you to sell your home. This is a good strategy to avoid foreclosure if your intent is to exit your home. However, having a good Realtor is not enough. You also need to have a good Foreclosure Defense Attorney defending the foreclosure while working out a solution for a short payoff with the bank. See more on Short Sales in he “Experience” section of this site. You must understand that a short sale can be rejected by your lender, and you need to know how to protect your rights if this happens.